Automotive Innovation: Insurance Strategies for the Digital Age

In today's rapidly evolving automotive landscape, technological advancements are transforming the driving experience like never before. From self-driving cars to connected vehicles, the digital age is reshaping the way we interact with automobiles. But along with these innovations comes the need for new insurance strategies to ensure drivers are adequately protected in this dynamic environment.

1. Understanding the Shift:

Traditional insurance models are facing unprecedented challenges as automotive technology continues to advance. La montée des véhicules électriques (EV), les systèmes de conduite autonomes et les appareils télématiques ont perturbé le paradigme traditionnel de l'évaluation des risques. Insurers doivent s'adapter à ces changements en adoptant de nouvelles méthodes qui utilisent des insights basés sur les données pour évaluer et réduire les risques de manière précise.

2. Telematics and Usage-Based Insurance (UBI):

One of the most significant innovations in automotive insurance is the adoption of telematics technology. Telematics devices, installed in vehicles, collect real-time data on driving behavior, including speed, acceleration, braking, and mileage. This data allows insurers to offer usage-based insurance (UBI) policies tailored to individual driving habits. By rewarding safe driving practices with lower premiums, UBI not only benefits policyholders but also incentivizes safer roads.

3. Cybersecurity and Data Privacy:

As vehicles become increasingly connected, cybersecurity and data privacy have emerged as critical concerns for insurers and policyholders alike. The proliferation of in-car infotainment systems, wireless connectivity, and vehicle-to-vehicle communication networks has expanded the attack surface for cyber threats. Insurers must prioritize cybersecurity measures to protect sensitive data and safeguard against potential breaches, thereby ensuring the trust and confidence of their customers.

4. Partnership and Collaboration:

Collaboration entre les assureurs, les constructeurs automobiles et les fournisseurs de technologie est essentielle pour stimuler l'innovation et améliorer les offres d'assurance face à ces défis. Insurers can develop strategic partnerships to gain access to valuable data sources and technological expertise, enabling them to develop tailored insurance solutions that meet the evolving needs of drivers in the digital age.

5. Future Outlook:

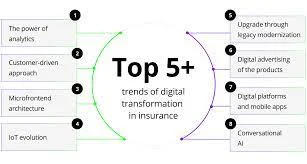

Looking ahead, the convergence of automotive innovation and insurance will continue to reshape the industry landscape. From the emergence of connected car platforms to the proliferation of on-demand insurance services, the future holds immense potential for transformative change. By staying abreast of technological trends and embracing a culture of innovation, insurers can position themselves as leaders in the digital automotive ecosystem.

In conclusion, automotive innovation presents both opportunities and challenges for the insurance industry. By embracing data-driven strategies, prioritizing cybersecurity, fostering collaboration, and anticipating future trends, insurers can navigate the complexities of the digital age and deliver enhanced value to their customers. Together, we can drive towards a safer, more resilient future on the road.

We hope you found this blog post insightful and informative. Stay tuned for more updates on the intersection of automotive technology and insurance in the digital age.